In this article, we will explore the various methods available for paying affiliates and help you determine which one is the easiest for your business. From traditional bank transfers to digital payment platforms, we will discuss the pros and cons of each option, as well as any potential challenges you may face. By the end of this article, you will have a clear understanding of the easiest way to pay your affiliates and can start implementing it into your affiliate marketing strategy.

Understanding Affiliate Marketing

Affiliate marketing is a popular and effective marketing strategy that involves promoting products or services through affiliates. These affiliates, also known as publishers or partners, are individuals or companies that promote the products or services of a merchant in exchange for a commission on each sale they generate. This form of marketing relies on the power of word-of-mouth and the influence of trusted individuals or organizations to drive sales and increase brand awareness.

Benefits of Affiliate Marketing

There are several benefits of affiliate marketing for both merchants and affiliates. For merchants, affiliate marketing provides a cost-effective way to reach a wider audience and increase sales without the need for large-scale advertising campaigns. It also allows merchants to tap into the expertise and influence of affiliates, who can provide valuable insights and recommendations to potential customers.

On the other hand, affiliates benefit from affiliate marketing by earning passive income through commissions. They can monetize their website traffic, social media followers, or email lists by promoting products or services that are relevant to their audience. This allows affiliates to diversify their revenue streams and earn money while engaging with their audience in a meaningful way.

How Does Affiliate Marketing Work?

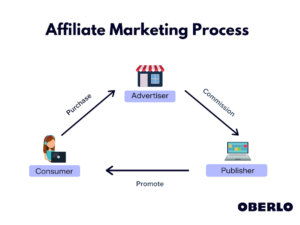

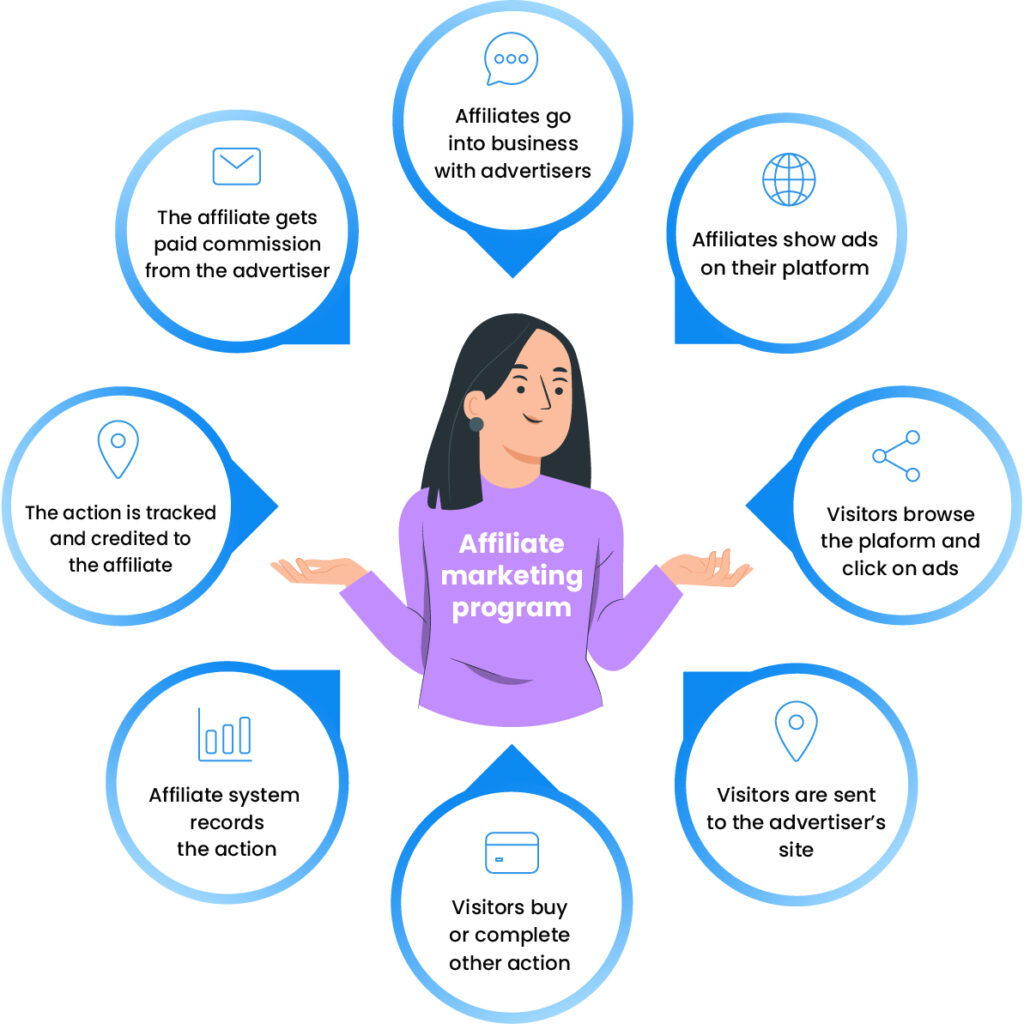

The process of affiliate marketing involves three main parties: the merchant, the affiliate, and the customer. The merchant is the company or individual that owns the product or service being promoted. The affiliate is the individual or company that promotes the product or service through their marketing channels. The customer is the individual who makes a purchase through the affiliate’s unique referral link.

When an affiliate joins an affiliate program, they are provided with a unique referral link or affiliate tracking code. This link or code allows the merchant to track the sales generated by the affiliate. When a customer clicks on the affiliate’s referral link and makes a purchase, the merchant’s tracking system records the sale and attributes it to the affiliate. The affiliate is then eligible to receive a commission based on the agreed-upon commission rate.

Importance of Proper Affiliate Payment

Proper and timely payment of affiliate commissions is crucial for maintaining strong relationships with affiliates. Affiliates work hard to promote a merchant’s products or services, and they rely on the promised commissions to compensate for their efforts. Failing to pay affiliates on time can have serious consequences and may lead to the deterioration of the affiliate relationship.

Why is it important to pay affiliates?

Paying affiliates promptly and accurately is essential for several reasons. Firstly, it ensures the affiliate’s trust and loyalty. If affiliates receive their commissions in a timely manner, they are more likely to continue promoting the merchant’s products or services and may even increase their efforts to generate more sales. This can result in a mutually beneficial partnership where both the merchant and the affiliate benefit.

Secondly, proper affiliate payment helps to maintain a positive reputation in the affiliate marketing community. Word travels fast in the affiliate industry, and affiliates often share their experiences with different merchants. If a merchant is known for not paying affiliates on time or refusing to honor commissions, it can deter affiliates from working with them in the future. This can hinder the growth of the affiliate program and limit the merchant’s potential for success.

Lastly, paying affiliates promptly helps to avoid legal issues and disputes. In some cases, affiliates may take legal action against a merchant who fails to pay commissions as agreed. This can result in costly lawsuits, damage to the merchant’s reputation, and potential financial losses. By fulfilling their payment obligations to affiliates, merchants can mitigate these risks and maintain a harmonious relationship with their partners.

Consequences of not paying affiliates on time

Failing to pay affiliates on time can have several negative consequences. Firstly, it can lead to a loss of trust and motivation among affiliates. If affiliates consistently experience delayed or missing payments, they may become demotivated and less inclined to continue promoting the merchant’s products or services. This can result in a decline in sales and a loss of potential revenue for the merchant.

Additionally, not paying affiliates on time can damage the reputation of the merchant. Affiliates often communicate with each other through affiliate forums, social media groups, and other channels. If affiliate marketers begin to spread negative experiences or warnings about a particular merchant’s payment practices, it can tarnish the merchant’s reputation and make it harder to recruit new affiliates in the future.

Furthermore, failing to pay affiliates on time may lead to legal issues. Depending on the terms and conditions of the affiliate program, the merchant may be legally obligated to pay commissions within a specified timeframe. If the merchant fails to meet these obligations, the affected affiliates may take legal action to recover the owed commissions. This can result in costly legal fees, damages, and an overall negative impact on the merchant’s business.

Safeguarding your affiliate relationships

To ensure the smooth and successful operation of an affiliate program, it is important to establish clear payment processes and communicate them effectively with affiliates. This includes setting payment expectations during the onboarding process, providing detailed instructions on how to set up payment accounts, and clearly defining the payment frequency and method.

Maintaining open lines of communication with affiliates is also crucial. Regularly updating affiliates on payment status, addressing any payment-related inquiries promptly, and resolving payment disputes in a transparent and fair manner can help build trust and strengthen the relationship between merchants and affiliates.

In addition, merchants should invest in reliable affiliate payment software or platforms that streamline the payment process and provide accurate tracking and reporting features. This can not only simplify the payment process but also provide merchants and affiliates with a centralized platform to monitor payment performance and resolve any issues that may arise.

Considerations for Affiliate Payments

Choosing the right payment method, determining appropriate commission rates, and establishing the payment frequency are key considerations when it comes to affiliate payments. These factors can impact the efficiency of the payment process, the satisfaction of affiliates, and the overall success of the affiliate program.

Choosing the right payment method

The choice of the payment method largely depends on the preferences and convenience of both the merchant and the affiliates. Some common payment methods used in affiliate marketing include PayPal, bank transfers, digital wallets, and even cryptocurrencies. Each payment method has its own advantages and considerations.

PayPal is a popular choice for affiliate payments due to its ease of use and widespread acceptance. Most affiliates already have PayPal accounts, which makes it convenient for them to receive payments. However, PayPal charges fees for receiving funds, and the availability of certain features may vary depending on the country or region.

Bank transfers are another common payment method in affiliate marketing. This method involves transferring funds directly from the merchant’s bank account to the affiliate’s bank account. Bank transfers are generally secure and reliable, but they can be more time-consuming and may incur additional fees, especially for international transfers.

Digital wallets, such as Skrill or Neteller, are also widely used in affiliate marketing. These wallets provide a convenient way for affiliates to receive payments, and many offer additional features like prepaid debit cards or the ability to exchange funds into different currencies. However, digital wallets may also charge fees for certain transactions or withdrawals.

Cryptocurrencies, such as Bitcoin or Ethereum, are gaining popularity in affiliate marketing due to their decentralized nature and low transaction fees. Using cryptocurrencies for affiliate payments can provide a higher level of security and anonymity for both merchants and affiliates. However, the acceptance of cryptocurrencies may still be limited, and affiliates may need to convert the received cryptocurrencies into fiat currencies to utilize them.

When choosing a payment method, it is important to consider the ease of use, fees, security, and the preferences of affiliates. Offering multiple payment options can also cater to the diverse needs and preferences of affiliates.

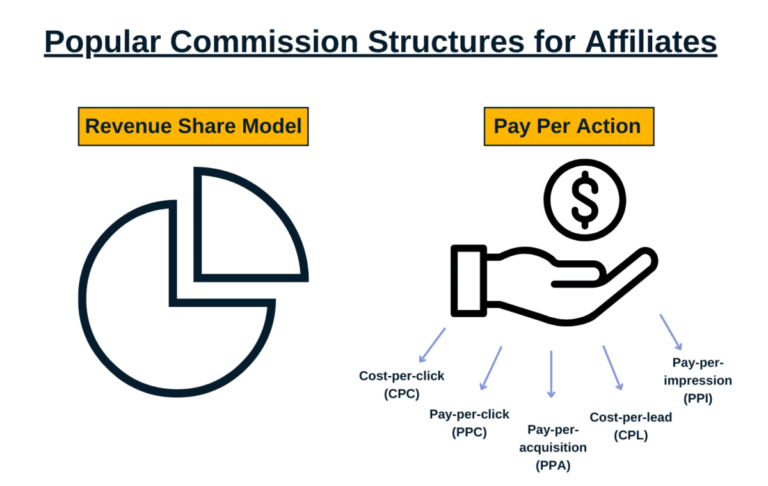

Factors to consider when setting affiliate commission rates

Determining the appropriate commission rates for affiliates is crucial for attracting and retaining high-quality partners. The commission rates should be competitive enough to motivate affiliates to put in effort and generate sales, but also reasonable for the merchant to sustain profitability. Several factors should be taken into consideration when setting commission rates.

Firstly, the industry average commission rates can serve as a benchmark. Researching and analyzing the commission rates offered by competitors or similar merchants can provide insights into the prevailing rates in the market. This can help merchants set competitive commission rates that are attractive to potential affiliates.

Additionally, the profit margins of the products or services being promoted should be considered. Lower-margin products may require higher commission rates to provide sufficient incentives for affiliates, while higher-margin products may allow for lower commission rates.

The level of effort required by affiliates to generate sales should also be taken into account. If promoting a particular product or service requires extensive content creation, advertising costs, or specialized knowledge, higher commission rates may be necessary to compensate for the effort and investment put in by affiliates.

Finally, the lifetime value of a customer can also influence the commission rates. If the products or services being promoted have a high customer retention rate or the potential for recurring sales, affiliates may be more willing to accept lower commission rates initially, knowing that they can earn additional commissions in the long run.

It is important to strike a balance between competitive commission rates and profitability for the merchant. Regularly reviewing and adjusting the commission rates based on the performance of affiliates and the profitability of the program can help ensure a fair and sustainable payment structure.

Determining payment frequency

Deciding on the payment frequency is another important consideration for affiliate payments. The payment frequency refers to how often affiliates will receive their commissions, whether it is weekly, bi-weekly, monthly, or based on other agreed-upon periods.

The payment frequency should be reasonable and align with the capabilities of the merchant. It is important to balance the need to provide quick payments to affiliates with the resources and processes available to the merchant for payment processing. For example, a merchant with a high volume of sales and a well-established payment system may be able to offer more frequent payments, while a smaller merchant may opt for less frequent payments to manage the workload and costs associated with payment processing.

The payment frequency should also take into consideration the payment threshold. The payment threshold is the minimum amount of commissions that must be earned before an affiliate is eligible for payment. This threshold helps minimize the administrative costs associated with processing small payments. Merchants should determine an appropriate payment threshold that is fair for both the merchant and the affiliates.

Regular communication with affiliates regarding the payment frequency and the expected payment dates is crucial to manage expectations and build trust. Consistently meeting the agreed-upon payment schedule will help maintain a positive relationship with affiliates and enhance their motivation to continue promoting the merchant’s products or services.

Popular Affiliate Payment Methods

There are several popular affiliate payment methods that merchants can choose from. Each payment method has its own advantages and considerations, and the choice ultimately depends on the preferences of the merchant and the affiliates.

PayPal

PayPal is a widely accepted and convenient payment method in the affiliate marketing industry. It allows merchants to transfer funds directly to the PayPal accounts of their affiliates. PayPal offers a user-friendly interface, secure transactions, and the ability to withdraw funds to a bank account or use them for online purchases. However, PayPal does charge fees for receiving funds, and the availability of certain features may vary depending on the country or region.

Bank transfer

Bank transfers are a traditional and reliable payment method used in affiliate marketing. This method involves transferring funds directly from the merchant’s bank account to the affiliate’s bank account. Bank transfers are generally secure and provide a convenient way to transfer large sums of money. However, bank transfers can be more time-consuming, especially for international transfers, and may incur additional fees.

Digital wallets

Digital wallets, such as Skrill or Neteller, are becoming increasingly popular in affiliate marketing. These wallets allow merchants to transfer funds directly to the digital wallets of their affiliates. Digital wallets offer the convenience of instant transfers and often provide additional features like prepaid debit cards or the ability to exchange funds into different currencies. However, digital wallets may charge fees for certain transactions or withdrawals, and the availability of certain features may differ between providers.

Cryptocurrencies

Cryptocurrencies, such as Bitcoin or Ethereum, are gaining traction in affiliate marketing due to their decentralized nature and low transaction fees. Merchants can transfer funds to affiliates using cryptocurrencies, allowing for secure and anonymous transactions. Cryptocurrencies offer the advantage of faster transactions and lower fees compared to traditional payment methods. However, the acceptance of cryptocurrencies may still be limited, and affiliates may need to convert the received cryptocurrencies into fiat currencies to utilize them.

Merchants should consider the preferences and convenience of their affiliates when choosing a payment method. Offering multiple payment options can cater to the diverse needs and preferences of affiliates and enhance their satisfaction with the payment process.

Avoiding Common Payment Challenges

Effective management of affiliate payments involves addressing common challenges that merchants may face when handling affiliate commissions. By implementing strategies and best practices, merchants can overcome these challenges and ensure smooth and accurate payment processes.

Tracking affiliate sales accurately

Accurate tracking of affiliate sales is crucial for determining the commissions owed to each affiliate. Without proper tracking, errors can occur, leading to incorrect payments or disputes. To prevent tracking discrepancies, merchants should invest in reliable affiliate tracking software or platforms.

Affiliate tracking software allows merchants to track and monitor the performance of their affiliates, providing real-time data on clicks, conversions, and sales. It also helps to ensure that each affiliate is properly attributed for the sales they generate. It is important to regularly review and validate the tracking data to identify any discrepancies or issues that may arise.

In addition to using tracking software, merchants should establish clear policies and guidelines regarding the tracking of affiliate sales. This includes defining the criteria for a valid referral, setting rules for cookie durations, and outlining any restrictions or limitations on certain types of sales or traffic sources.

Regularly communicating with affiliates about the tracking process and providing access to tracking data can also help build trust and transparency. Affiliates should have the ability to monitor their performance and verify that their efforts are properly tracked and credited.

Dealing with fraudulent affiliate activities

Fraudulent affiliate activities can pose significant challenges for merchants, leading to financial losses and damage to their reputation. Fraudulent activities can include fake orders, unauthorized use of promotional materials, or attempts to manipulate sales and commission data.

To mitigate the risks associated with fraudulent activities, merchants should implement strict screening processes when recruiting affiliates. This may include conducting background checks, verifying the authenticity and quality of the affiliate’s marketing channels, and monitoring the affiliate’s performance and traffic sources.

Regular monitoring and analysis of sales and commission data can help identify patterns or anomalies that may indicate fraudulent activities. Merchants should establish clear policies and guidelines on what constitutes fraudulent behavior and the consequences for affiliates engaging in such activities. This can act as a deterrent and help maintain the integrity of the affiliate program.

If fraudulent activities are detected, it is important to take prompt action to protect the interests of the merchant and other affiliates. This may involve suspending or terminating the affiliate’s account, withholding commissions, or pursuing legal action if necessary.

Resolving payment disputes

Payment disputes can arise for various reasons, such as discrepancies in tracking data, disagreements over commission calculations, or issues with payment methods. It is important for merchants to establish a clear payment dispute resolution process to handle these situations.

When a payment dispute occurs, both parties should have an opportunity to present their case and provide any supporting documentation. Merchants should carefully review the dispute and objectively assess the validity of the claims. Effective communication and prompt response to payment disputes can help alleviate tensions and maintain the trust and confidence of affiliates.

Engaging in open and transparent dialogue with affiliates is key to resolving payment disputes. Merchants should clearly communicate their payment policies, provide explanations for any discrepancies or delays, and work towards an amicable solution. In some cases, it may be necessary to involve a third party, such as an affiliate network or an unbiased mediator, to assist in resolving the dispute.

By implementing strategies to track affiliate sales accurately, prevent fraudulent activities, and effectively resolve payment disputes, merchants can minimize the challenges associated with affiliate payments and maintain strong relationships with their affiliates.

Benefits of Using Affiliate Payment Platforms

Using affiliate payment platforms can offer several benefits for merchants, making the payment process more efficient, streamlined, and secure. These platforms provide a centralized solution for managing affiliate payments and offer features that enhance transparency, tracking, and reporting.

Streamlining payment processes

Affiliate payment platforms automate and streamline the payment process, reducing the administrative burden on merchants. These platforms often integrate with popular affiliate tracking software or networks, allowing for seamless transfer of commission data and facilitating quick and accurate payments to affiliates. Merchants can schedule payments in advance, set up recurring payments, and ensure that affiliates are paid on time and in accordance with the agreed-upon terms.

Automated affiliate tracking and reporting

Affiliate payment platforms provide merchants with tools to track and analyze the performance of their affiliates in real-time. This includes monitoring clicks, conversions, sales, and other key performance indicators. Accurate tracking and reporting help merchants gain valuable insights into the effectiveness of their affiliate program and make data-driven decisions to optimize their marketing efforts.

Automated reporting features also enable merchants to generate customized reports for affiliates, providing them with detailed information about their performance, earnings, and upcoming payments. This transparency helps build trust and strengthens the relationship between merchants and affiliates.

Enhanced payment security

Affiliate payment platforms prioritize the security of payment transactions, protecting sensitive information and minimizing the risk of fraud. These platforms often implement industry-standard encryption protocols and security measures to safeguard payment data. Merchants can also choose to integrate additional security features, such as two-factor authentication or anti-fraud tools, to further enhance payment security.

Using affiliate payment platforms can provide peace of mind for both merchants and affiliates, knowing that their payment information is securely stored and processed. This can help build trust and confidence in the affiliate program, attracting high-quality affiliates and fostering long-term partnerships.

Choosing the Right Affiliate Payment Software

Choosing the right affiliate payment software is crucial for ensuring a smooth and efficient payment process. There are several key features that merchants should consider when evaluating different payment software options.

Key features to look for in an affiliate payment platform

-

Integration capabilities: The payment software should seamlessly integrate with popular affiliate tracking software or networks, allowing for efficient transfer of commission data and enabling accurate tracking and reporting.

-

Payment scheduling and automation: The software should provide the ability to schedule payments in advance, set up recurring payments, and automate the payment process to ensure timely and accurate payments to affiliates.

-

Multiple payment options: The payment software should support multiple payment methods, allowing merchants to offer flexibility and convenience to their affiliates.

-

Security and fraud prevention: The software should prioritize payment security and implement measures to protect against fraudulent activities, such as two-factor authentication or anti-fraud tools.

-

Customizable reports: The software should provide merchants with the ability to generate customized reports for affiliates, offering detailed insights into their performance, earnings, and upcoming payments.

-

Customer support: The software provider should offer reliable customer support to assist merchants in resolving any technical issues or questions that may arise.

-

Scalability and flexibility: The software should be able to accommodate the growing needs of the affiliate program and easily adapt to changes in payment processes or requirements.

Comparing different payment software options

There are several popular affiliate payment software providers in the market. Each software has its own set of features, pricing models, and user interface. Merchants should carefully evaluate different options based on their specific needs, budget, and the requirements of their affiliate program.

Some commonly used affiliate payment software providers include:

-

AffiliateWP: AffiliateWP is a popular affiliate payment software that integrates seamlessly with WordPress. It offers features such as automated affiliate registration, commission tracking, and payment automation. The software is user-friendly and provides extensive reporting capabilities.

-

Post Affiliate Pro: Post Affiliate Pro is a comprehensive affiliate management platform that includes payment processing capabilities. It offers a wide range of features, such as advanced tracking and reporting, fraud detection, and multi-tier commissions. The software supports various payment methods and provides customizable payment options.

-

Refersion: Refersion is an affiliate marketing and tracking platform that also offers payment processing capabilities. It provides features such as seamless integrations with popular e-commerce platforms, real-time reporting, and commission automation. The software supports multiple payment methods and offers customizable payment schedules.

-

Tapfiliate: Tapfiliate is a cloud-based affiliate tracking and payment software that offers a user-friendly interface and extensive reporting capabilities. It supports multiple payment methods, provides commission automation, and offers advanced features such as multi-language support and custom branding.

Merchants should carefully evaluate the features, pricing, and user reviews of different affiliate payment software options to determine the best fit for their specific needs and requirements.

Implementing Affiliate Payment Systems

Implementing affiliate payment systems involves integrating payment processes with the overall affiliate program and providing clear instructions and support to affiliates. This ensures that the payment process is efficient and transparent, and that affiliates have a positive experience when receiving their commissions.

Integrating payment systems with your affiliate program

To effectively integrate payment systems with the affiliate program, merchants should ensure that all affiliates have access to the necessary payment information and instructions. This includes providing affiliates with clear guidelines on how to set up payment accounts, indicating the preferred payment methods, and explaining the payment schedule and any applicable payment thresholds.

Merchants should also establish a streamlined communication process with affiliates regarding any changes or updates to the payment systems. Regularly informing affiliates about upcoming payment cycles, payment delays, or any other relevant payment-related information can help manage expectations and build trust.

Furthermore, integrating the affiliate tracking software or network with the chosen payment system is crucial for ensuring accurate and timely payments. Merchants should ensure that the tracking system is properly configured to record affiliate sales and that the payment system can retrieve the necessary data for processing payments.

Providing clear instructions for affiliates

Clear and concise instructions for affiliates regarding payment setup and requirements are essential to minimize confusion and ensure a smooth payment process. Merchants should provide step-by-step guides or tutorials that explain how to set up payment accounts, select the preferred payment method, and input the necessary payment information.

Merchants should also outline any specific requirements or restrictions related to payment methods. For example, if a particular payment method is only available to affiliates in certain regions, this information should be clearly communicated to avoid any misunderstandings.

Visual aids, such as screenshots or video tutorials, can also be helpful in guiding affiliates through the payment setup process. The goal is to make the instructions as user-friendly and easy to follow as possible, ensuring that affiliates can set up their payment accounts without encountering any unnecessary difficulties.

Testing and optimizing payment processes

Regular testing and optimization of the payment processes are essential to identify any potential issues or areas for improvement. Merchants should conduct thorough tests to validate the accuracy of tracking data, payment calculations, and payment transfers.

Testing should include simulating various scenarios, such as affiliate sales from different traffic sources, refunds or chargebacks, and payments to affiliates with different payment methods. This will help merchants identify any potential glitches or discrepancies and address them before they affect the payment process.

Merchants should also seek feedback from affiliates regarding their payment experience. This can be done through surveys, feedback forms, or direct communication. By gathering feedback and suggestions from affiliates, merchants can identify pain points, improve the payment process, and enhance the overall affiliate experience.

Ensuring Compliance and Tax Obligations

Complying with affiliate payment regulations and understanding the tax obligations associated with affiliate payments is crucial to stay on the right side of the law and avoid any legal issues. Merchants should familiarize themselves with the relevant regulations and ensure proper record-keeping practices.

Complying with affiliate payment regulations

Different countries or regions may have specific regulations or requirements related to affiliate payments. Merchants should be aware of these regulations and ensure compliance to avoid legal consequences.

Some common issues to consider include:

-

Payment thresholds: Certain countries or states may have regulations regarding the minimum amount of commissions owed before a payment can be made. Merchants should ensure that payment thresholds are set in accordance with these regulations.

-

Sales tax obligations: Some jurisdictions may require merchants to collect and remit sales tax on affiliate sales. Merchants should familiarize themselves with the tax laws in the jurisdictions where their affiliates are located and ensure proper compliance.

-

Affiliate disclosures: In some jurisdictions, affiliates may be required to disclose their relationship with the merchant when promoting their products or services. Merchants should provide clear guidelines to affiliates regarding these disclosure requirements to ensure compliance.

It is advisable to consult with legal or tax professionals to ensure full compliance with the regulations applicable to affiliate payments.

Understanding tax obligations for affiliate payments

Merchants should also understand their tax obligations related to affiliate payments. Affiliate commissions are typically considered taxable income and may be subject to income tax, self-employment tax, or other tax obligations depending on the jurisdiction.

Merchants should consult with tax professionals or accountants to ensure that they are meeting their tax obligations and filing the necessary tax returns. Proper record-keeping is essential for accurately reporting affiliate payments and deductions.

Maintaining detailed records of affiliate payments, including the affiliate’s personal information, the amount of commissions paid, and the dates of payments, can help facilitate tax compliance. Merchants should also issue appropriate tax forms, such as Form 1099-MISC in the United States, to affiliates who meet the reporting thresholds.

By understanding and fulfilling their compliance and tax obligations, merchants can avoid legal issues, maintain a positive reputation, and ensure a smooth operation of their affiliate program.

Monitoring Affiliate Payment Performance

Monitoring the performance of affiliate payments is crucial to identify any payment-related issues, analyze the effectiveness of the payment process, and make data-driven decisions to optimize the affiliate program.

Tracking payment success rates

Monitoring the success rates of affiliate payments provides valuable insights into the efficiency and reliability of the payment process. Merchants should track the overall payment success rate, which represents the percentage of payments that are successfully processed without any issues or delays.

By analyzing the payment success rate, merchants can identify any payment-related issues, such as rejected payments, incorrect transfer details, or technical glitches. This allows them to take the necessary measures to rectify the issues and ensure timely and accurate payments to affiliates.

It is also important to analyze the payment success rate on an individual affiliate basis. This can help identify any recurring issues or patterns associated with specific affiliates. For example, if a particular affiliate consistently experiences payment delays or errors, it may indicate a problem with their payment setup or tracking data. Addressing these issues promptly can help cultivate a positive relationship with affiliates and enhance their satisfaction with the payment process.

Analyzing affiliate payment data

Analyzing affiliate payment data provides merchants with valuable insights into the performance and effectiveness of their affiliate program. Merchants should review and analyze data such as the total amount of commissions paid, the number of successful conversions generated by affiliates, and the average commission rates.

By analyzing this data, merchants can identify the top-performing affiliates and the products or services that are driving the most sales. This can help optimize marketing efforts, identify potential areas for growth, and allocate resources effectively.

Furthermore, analyzing payment data can help merchants identify trends or patterns related to payment frequency, preferred payment methods, or payment-related issues. This information can be used to improve the payment process, address any payment-related concerns, and enhance the overall payment experience for affiliates.

Identifying payment-related issues and improvements

Regularly monitoring and analyzing affiliate payment performance allows merchants to identify any payment-related issues and make improvements to the payment process. This includes addressing any payment delays, resolving payment disputes, or implementing system upgrades to enhance the efficiency and accuracy of payments.

By promptly addressing payment-related issues and continuously optimizing the payment process, merchants can ensure a smooth and hassle-free payment experience for affiliates. This, in turn, can strengthen the affiliate relationships and contribute to the overall success of the affiliate program.

Communication and Transparency

Building strong relationships with affiliates requires effective communication and transparency throughout the payment process. Merchants should set clear payment expectations, provide regular updates on payment status, and promptly address any payment-related inquiries or concerns.

Setting clear payment expectations

Clear and transparent communication from the outset is essential for establishing trust and maintaining a positive relationship with affiliates. During the onboarding process, merchants should provide clear guidelines and expectations regarding the payment process. This includes clearly stating the payment frequency, the preferred payment methods, and any applicable payment thresholds.

Merchants should also provide information on any potential delays or issues that may affect the payment process. For example, if there is a scheduled maintenance period or a temporary disruption in payment services, affiliates should be informed in advance to manage their expectations.

By setting clear payment expectations, merchants can minimize any confusion or misunderstandings and ensure that affiliates have a clear understanding of the payment process.

Regularly updating affiliates on payment status

Regular communication and updates regarding payment status are essential to keep affiliates informed and engaged. Merchants should establish a clear communication plan to provide regular updates on the status of payments, especially if there are any delays or issues.

This can be done through email newsletters, affiliate portals, or dedicated communication channels. Merchants should communicate the payment schedule, any changes or updates to the payment process, and provide estimated payment dates. It is important to provide accurate and timely information to maintain the trust and confidence of affiliates.

Addressing payment-related inquiries promptly

Promptly addressing any payment-related inquiries or concerns is crucial for maintaining a positive relationship with affiliates. Merchants should establish a dedicated channel, such as a support email or a helpline, to handle payment inquiries and provide timely responses.

When addressing payment-related inquiries, merchants should be transparent, provide accurate information, and offer timely resolutions. This can include providing updates on payment processing status, clarifying any discrepancies in commission calculations, or explaining the reasons for payment delays.

Merchants should prioritize resolving payment-related inquiries promptly to ensure that affiliates feel valued and supported. By providing excellent customer support, merchants can strengthen the trust and loyalty of their affiliates and enhance the overall affiliate experience.

Building Strong Relationships with Affiliates

Building strong relationships with affiliates is essential for the long-term success of an affiliate program. Merchants should focus on providing excellent customer support, offering incentives and bonuses for outstanding performance, and creating a fair and transparent payment structure.

Providing excellent customer support

Excellent customer support is vital for building trust, enhancing the affiliate experience, and maintaining strong relationships. Merchants should establish efficient communication channels, such as dedicated email support or a helpline, to address any issues or concerns that affiliates may have.

Merchants should respond promptly to inquiries, provide accurate and helpful information, and offer personalized assistance when needed. This can include guiding affiliates through the payment setup process, explaining commission calculations, or addressing any technical issues related to the payment system.

By providing excellent customer support, merchants can foster a positive relationship with affiliates, enhance their satisfaction with the affiliate program, and encourage long-term loyalty.

Offering incentives and bonuses for outstanding performance

Incentives and bonuses can motivate affiliates to perform at their best and go the extra mile in promoting the merchant’s products or services. Merchants should consider implementing performance-based incentives, such as increased commission rates for top-performing affiliates or bonuses for achieving specific sales targets.

These incentives can be communicated to affiliates through newsletters, dedicated announcements, or personalized messages. By recognizing and rewarding exceptional performance, merchants can cultivate a sense of appreciation and motivation among affiliates, resulting in increased sales and a stronger partnership.

Creating a fair and transparent payment structure

A fair and transparent payment structure is essential for building trust and maintaining a positive relationship with affiliates. Merchants should clearly communicate the commission rates, payment methods, and payment frequency to affiliates from the outset.

It is important to ensure that the payment structure is equitable and aligns with industry standards and the efforts required by affiliates. Merchants should regularly review commission rates and payment policies to ensure that they remain competitive and fair.

Transparent reporting and accurate tracking of affiliate sales are also crucial for a fair payment structure. Merchants should provide affiliates with access to detailed reports, clearly showing the number of clicks, conversions, and sales generated. This helps affiliates understand how their efforts contribute to their earnings and increases their trust in the payment process.

Merchants should also provide affiliates with access to centralized payment portals or dashboards where they can view their payment history, track pending payments, and update their payment information. This level of transparency and self-service capability enhances the overall payment experience for affiliates.

Conclusion

Efficient and timely payment of affiliate commissions is crucial for maintaining strong relationships with affiliates and ensuring the success of an affiliate program. Merchants should prioritize proper payment practices, including choosing the right payment method, setting competitive commission rates, and establishing a transparent payment structure.

By using reliable affiliate payment software, merchants can streamline the payment process, automate tracking and reporting, and enhance payment security. Careful consideration should be given to the features and capabilities of different software options to ensure the best fit for the specific needs of the affiliate program.

With clear communication, regular updates on payment status, and prompt resolution of payment-related inquiries, merchants can foster trust and transparency with affiliates. By providing excellent customer support and offering incentives for outstanding performance, merchants can strengthen relationships and encourage long-term loyalty.

Efficient affiliate payment methods, combined with a fair and transparent payment structure, contribute to the overall success and growth of an affiliate program. By continuously monitoring payment performance, analyzing data, and making necessary improvements, merchants can optimize the payment process and ensure a positive experience for their affiliates.

Choosing the easiest way to pay affiliates involves considering their preferences, efficiency, transparency, and security. By prioritizing these factors and implementing best practices, merchants can build strong and successful affiliate relationships and maximize the potential of their affiliate program.

This post was made with AIWiseMind. Click here to learn more.